Want to extract more funds from your budget? Groceries can devour a large chunk of your earnings, but with some savvy tactics, you can whittle that expense down. First, make a thorough meal plan for the week and stick to it. This helps prevent impulse buys at the store. Next, turn yourself into a coupon hunting master. Check newspapers, online resources, and even your local shop's website for savings opportunities.

Before you make to the supermarket, examine your pantry and fridge. This exposes what you already have, helping you assemble a shopping list that avoids unnecessary purchases.

Shop around between different brands and consider store-brand goods which are often just as good but cost less. And don't forget to factor in the total cost per unit, not just the sticker price. When it comes to produce, go with seasonal fruits which are usually more cheap. Ultimately, a little planning and smart thinking can markedly diminish your grocery bill, leaving you with more funds to spend on the things that truly count.

Conquer The Art of Smart Shopping & Save Big

Ready to ditch those expensive impulse buys and become a savvy shopper? Embracing the art of smart shopping isn't just about finding deals; it's a mindset shift that can revolutionize your spending habits for the better. Start by building a spending plan and stick to it like glue. Compare prices before you buy, take coupons and discounts, and think about buying secondhand items. By practicing these simple strategies, you can minimize your spending and gather big bucks in the process.

- Shop around for the best prices online and offline.

- Wait on non-essential purchases until they are on sale.

- Contrast different brands and models before making a decision.

Reduce Regular Spending: Easy Tips & Tricks

Cutting back on everyday spending doesn't have to be a tedious process. Start by making a spending plan to monitor where your money is going. Examine for places where you can trim expenses, such as takeout food. Consider preparing more meals at home to save money. Moreover, compare prices on essentials to confirm you're getting the best value.

- Employ cash instead of plastic.

- Uncover free or inexpensive leisure activities.

- Limit services you don't use regularly.

By incorporating these easy tips, you can effectively minimize your regular spending and free up more money towards your aspirations.

Slash Deep Discounts on Basic Needs

Tired of shelling out a small fortune for the things you need most? We've got you covered! Discover amazing deals on groceries and make your wallet work smarter, not harder. Whether you're stocking up on necessities or just looking for a steal, we have the best prices around. Snag your savings today!

- Explore our digital store for a wide selection of products.

- Compare prices and locate the top offers.

- Join our membership program to receive even more money off.

Dominate Your Budget with These Savings Secrets

Tired of feeling anxious about money? Worried that your expenses are getting out of hand? You're not alone! Many people have a hard time with budgeting, but it doesn't have to be a pain. With a few simple tricks, you can control your budget and achieve your financial goals.

Here are some tips to help you save money:

* Monitor Your Expenses

Start by identifying where your money is going. Use a budgeting app, spreadsheet, or even a simple notebook to keep of every expenditure.

* Create a Budget

Once you know how much money you're spending, you can formulate a budget that fits your needs. Allocate your income to necessary expenses first, then evaluate your aspirations.

* Find Areas to Cut Back

Examine for areas where you can trim your expenses. Can you bargain lower prices on bills? Are there any plans you're not using?

* Establish Financial Targets

Having financial objectives can help you stay driven. What are you saving for? A new house? Retirement? Recognizing your goals will make it easier to adhere to your budget.

Embrace Minimalism: Savvy Spending for Abundance

Want to achieve financial independence? It's easier than you think! By embracing a frugal approach, you can tap into a world of possibilities. Start by acquiring consciously. Compare prices, look discounts, and analyze your needs before making any expenditures.

- Record your spending to recognize areas where you can cut back.

- Prepare meals at home instead of eating out at restaurants.

- Investigate free or low-cost hobbies in your community.

Remember, Save on regular spending living frugally isn't about sacrifice. It's about choosing your money wisely so you can spend it on what truly matters. By modifying your spending behaviors, you can live a more fulfilling and sound life.

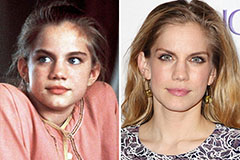

Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Ariana Richards Then & Now!

Ariana Richards Then & Now! Robert Downey Jr. Then & Now!

Robert Downey Jr. Then & Now! Jenna Jameson Then & Now!

Jenna Jameson Then & Now! Brooke Shields Then & Now!

Brooke Shields Then & Now!